The First Advantage Service Provider edition provides payroll firms, accounting firms, HR and benefits consultants the ability to offer their clients with 300 or less employees an Affordable Care Act monitoring and reporting service without the hassles, resource drain and cost of developing an internal program. Our service provider solution allows a service provider to utilize this tool as if it was their proprietary program. You, the service provider, can help your clients track and monitor employees hours, determine which employees must be offered coverage, easily compile and aggregate massive amounts of data for IRS reporting requirements and provide your client with the necessary documentation in case of an audit.

Make The ACA Advantage Service Provider Edition Your Own!

Login into the system, set up your clients individually and manage them through the solution. Efficiently provide consulting and analysis around the Employer Mandate and reporting requirements, and configure client usage.

See How it Works Compare Products

The Service Provider edition helps you create the framework and tools for your clients to easily:

- track and monitor employee hours;

- determine which employees must be offered coverage;

- compile and aggregate data for IRS reporting; and

- distribute the necessary audit documentation

About the Service Provider Solution

The Service Provider solution allows employers to upload their data and instantly know their status in relation to ACA requirements. This tool does all the work and analysis for the company by:

- providing average employee hours for the applicable measurement period;

- identifying employees exceeding the ACA threshold for offer of insurance coverage;

- compiling and aggregating all the data needed for IRS reporting; and

- supplying audit documentation.

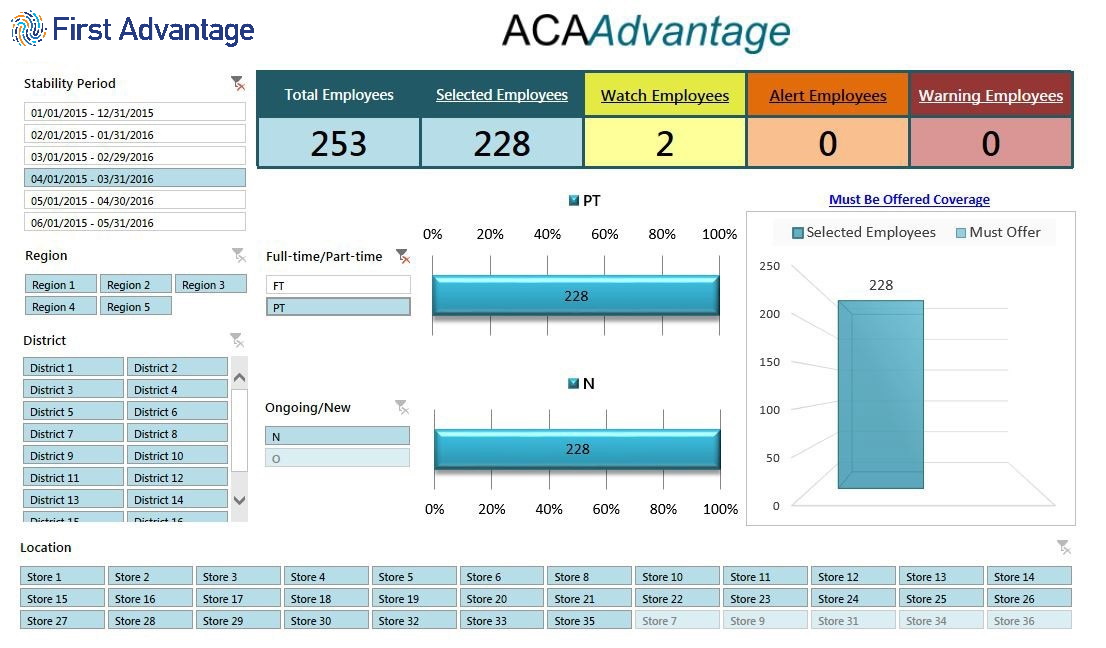

Our solution allows an employer to see who is trending towards benefits eligibility throughout the Measurement Period, and when the Administration Period arrives, to identify employees who must be offered coverage under the ACA regulations. This consistent monitoring of employee hours throughout the Measurement Period assists employers with forecasting insurance costs and penalty exposure well in advance of business need..

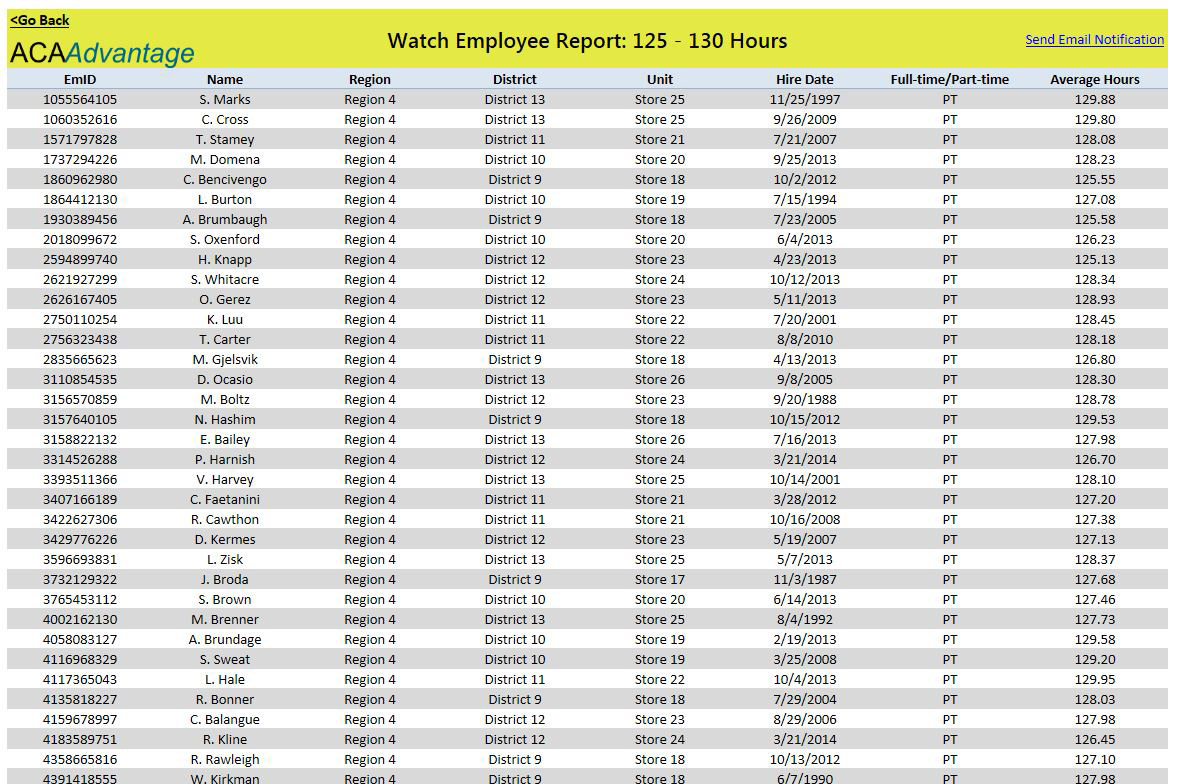

Self Provider users can monitor actual hours worked by variable hour employees during applicable measurement periods. The employer can identify its employees who are approaching the 130 hour per month threshold and those employees who have exceeded the 130 hour threshold. The tools harness the employer's big data to proactively manage the variables directly impacting ACA employer mandate requirements.

Manual Spreadsheets Are Not Efficient

With ACA Advantage you don't need to pay employees for the arduous tasks of creating and populating manual spreadsheets, aggregating, analyzing and manipulating masses of data and preparing ACA calculations. This solution automates the process for you.

It's all in the features!

The service provider solution allows you and your clients to see which employees are trending towards benefits eligibility throughout the Measurement Period and identifies employees eligible for coverage under the ACA rules.

Easy to see at any moment in time who qualifies or is on track to qualify for an offer of coverage and help you forecast insurance costs and penalty risk for your clients.

Be Proactive

You can monitor actual hours worked by variable hour employees during the applicable measurement period and identify employees approaching the 130 hour per month threshold as well as those who exceeding the 130 hour threshold.

Drill Down into your Organizational Structure

ACA Advantage allows your clients to drill down into information specific to their OU structure from headquarters to store/location levels. The drill down functionality of ACA Advantage allows you and your clients to view activity from the overall company level down to the individual business location or unit.

Features of the ACA Advantage™ Service Provider Solution

Monthly Hours Summary Dashboard – Monitor employee monthly average hours through the measurement period and allow your clients instant visibility to employee status against the ACA monthly 130-hour threshold.

Weekly Hours Summary Dashboard – Providing your client upload feed identifies hours on a weekly basis, the dashboard allows you and your client to monitor weekly employee hours throughout the measurement period to compare employee status against the ACA weekly 30-hour threshold. This dashboard is important for companies that want to keep an eye on employee hours while insuring adequate staffing levels from week to week.

Notification to Managers – Notify your client's managers of the employee status throughout the measurement period and provide comments and/or instructions as needed.

Grant Limited Access to View the Information in The Solution – ACA Advantage allows you to set up numerous user permissions for your clients that may be restricted to specific information so that certain individuals can utilize the tools to see only the information relevant to them.

Report Generation – ACA Advantage aggregates massive amounts of data to help you and your client with their ACA Employer Mandate reporting requirements, with the ability to look at specific reports and queue custom reports.

Affordability Confirmation –Help mitigate the risk of penalties being assessed against your client. This tool provides an Affordability Confirmation Report documenting that the insurance coverage offered based on the wages earned by employees through the measurement period is affordable.

IRS Forms and Audit Documentation – ACA Advantage has the data needed to populate ACA required IRS Forms or allows you to populate the forms for your clients. Further, the solution produces the support needed to substantiate IRS reporting and provides it at your fingertips long before you or your client will ever need it.